Imagine two of your colony’s biggest shopkeepers—say, Sharmaji and Vermaji—get into a fight. Sharmaji (America) says Vermaji (China) is selling goods too cheap, taking all his customers, and not buying enough from Sharmaji’s shop. So, Sharmaji slaps a “fine” (called tariffs) on Vermaji’s products.

That’s what’s happening now between USA and China.

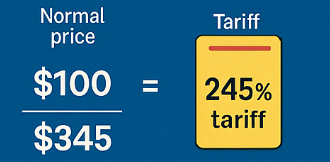

The US has slapped 245% tariffs on Chinese goods. This means that if a product made in China earlier cost ₹100 in America, now it could cost ₹345. Naturally, fewer Americans will buy it.

China says, “Fine, we’ll also tax your goods heavily when they come to us.”

This tit-for-tat is called a Trade War.

Tariff = Tax on Imported Goods

Let’s say you buy a phone online, and it’s imported from China. Normally, it costs ₹20,000.

Now, the government adds 245% tax on it = ₹49,000 extra.

👉 Now you pay ₹69,000 instead of ₹20,000.

Naturally, buyers will look for Indian-made phones instead.

Trump’s plan, called the “Fair and Reciprocal Plan,” says:

If other countries (like China) are not buying much from us, we will also stop buying from them.

This will protect American companies and jobs.

Also, this pressure will force countries to negotiate fairer trade deals.

Sounds smart, right? But…

Stock markets in the US, Europe, and Asia (including India’s Sensex & Nifty) are falling. Why? Because investors hate uncertainty. Tariffs = expensive trade = slowed businesses = lower profits = fear of recession.

Companies like Honda have moved their car production from Japan to the US just to avoid 25% tariffs. This affects how supply chains work globally—including in India, where parts are often made or assembled.

Nvidia, which makes AI chips, says it may lose $5.5 billion because it can’t freely sell to China anymore.

👉 Why does this matter?

Because many AI products used by Indian developers and businesses depend on Nvidia hardware.

While this is a US-China fight, India is not sitting in the audience—we’re in the splash zone.

Some US companies might look to India instead of China for manufacturing.

Indian exporters may get new orders from US buyers who want alternatives to China.

Our auto and pharma sectors might gain temporarily if China faces restrictions.

Prices of imported items (like electronics, car parts, AI hardware) might go up globally, including in India.

If global trade slows down, Indian exporters may lose demand too.

A weak Chinese economy can impact global supply chains that India is also part of.

China is warning that it won’t tolerate being bullied. It wants a dialogue based on equality. Officials even said they want to “shake hands, not fists.” But for now, they’ve hit back with their own set of tariffs and are preparing more internal policies to handle the pressure.

Trump says:

“Inflation is down. Our farmers are protected. Promises made, promises kept!”

But economists warn that these tariffs could hurt the global economy, raise prices, and hit even American consumers and workers in the long run.

It’s like trying to fix a leaking tap with a hammer—short-term pressure relief, but risky.

That smartwatch you’ve been eyeing on Amazon, made in China, may suddenly cost more.

Your cousin’s company in Noida that exports auto parts might get more orders from American firms avoiding China.

Or your IT firm might get caught in the crossfire if it depends on hardware blocked by trade bans.

Trump is open to pausing some tariffs, like on auto parts, to give industries time to adjust.

India must tread carefully, ensuring we stay friends with both giants, and position ourselves as a reliable trade partner.

This US-China trade war is not just a global power struggle. It’s a money war that impacts jobs, industries, prices—and you.

So next time someone says “tariff,” don’t just nod. Think of it as a tax battle where every product becomes a pawn, and the entire world is watching who will blink first.